For likely the final time, the IRS has issued Notice 76 extending by 30 days the 21 deadline to furnish the Forms 1095B and 1095C to individuals The Notice mirrors the same 30day extensions for the past four years of ACA reporting However, the IRS added this year that unless it receives "comments that explain why this relief continues to be necessary," the 30Employers have until January 31 to send the form to their employees Thus, a 1095C form will be sent in early January 21ALEs are required to send Form 1095C to all fulltime employees as defined by ACA (those who work an average of 30 or more hours per week in any given month) Accordingly, Form 1095C will be

2

1095 c form 2021

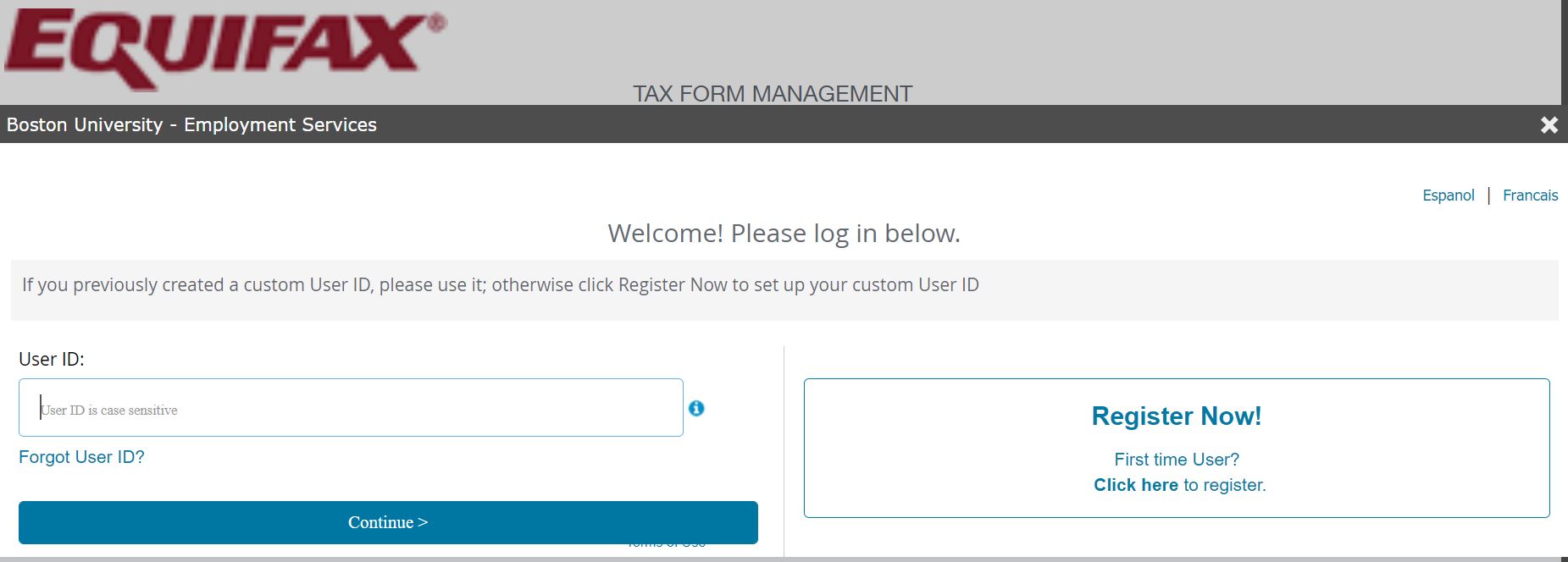

1095 c form 2021- News from You do not need the 1095C form to file or to attach to your taxes However the Affordable Care Act (ACA) requires Penn to send these forms to certain benefitseligible faculty and staff members The 1095C forms were mailed on 2/16 from Equifax and are now available online The paper filing deadline is Feb 28, 21, and the efiling deadline is As your employees start to receive tax forms, review these questions that they may have regarding Form 1095C and what to do with it

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

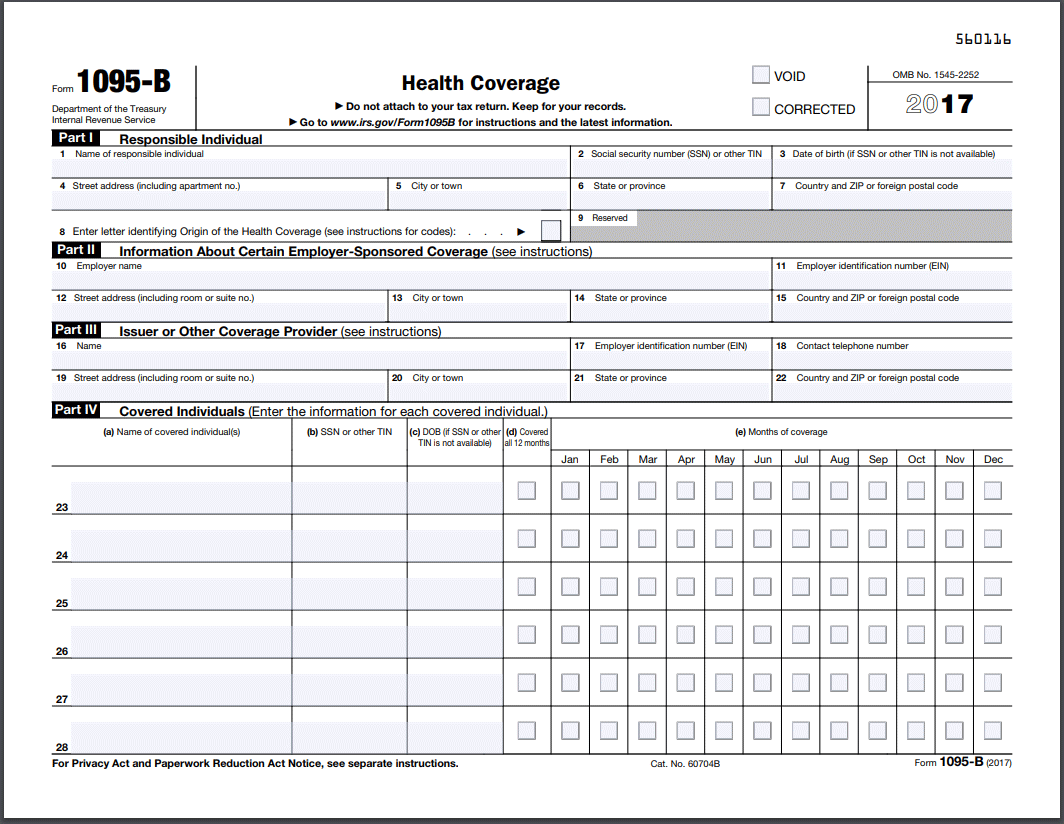

In accordance with requirements of the Affordable Care Act and various reporting requirements of other jurisdictions, UC employees and retirees will receive 1095B and/or 1095C forms verifying their health coverage for In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting document While not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094Cs First, the due date for furnishing Form 1095B and Form 1095C to participants has been extended from to The Notice does not extend the Form 1094B and Form 1094C filing date with the IRS, which will remain at for paper filers and if filing electronically

Very carefully confirm the content of the form as well as grammar along with punctuational Navigate to Support area when you have questions or perhaps handle our Assistance team Place an electronic digital unique in your Form 1095C by using Sign Device After the form is fully gone, media CompletedForm 1095C State filing Forms 1094C and 1095C to the DC Office of Tax and Revenue (likely to include any federal extension) Deadline is 30 days after IRS deadline, including any extensions granted New Jersey Employee/nonemployee delivery Form 1095C State filing Form 1095C to the NJ Department of the Treasury IRS Issues Draft Form 1095C for ACA Reporting in 21 Revisions could require employers to alter existing reporting systems smiller@shrmorg

Updates to Form 1095C for Filing in 21 Updates to Form 1095C for Filing in 21 Watch later Share Copy link Info Shopping Tap to unmute If playback doesn't begin shortly, try1095c deadline 21 Make use of a digital solution to create, edit and sign contracts in PDF or Word format on the web Convert them into templates for multiple use, include fillable fields to collect recipients? Form 1094C is unchanged from last year Form 1095C changes include Employee's age as of January 1 of the reporting year The IRS will now require an entry for the Age of each employee as of This will be in Part 2 on the 1095C form

2

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

The IRS has announced a postrelease addition to the codes for the Form 1095C (see our Checkpoint article ) According to an IRS website post, an applicable large employer that offers an individual coverage HRA (ICHRA) can use two previously reserved codes from Code Series 1 on Form 1095C, line 14, for reporting offers of coverage for In 21, you will be furnished with a Form 1095C reporting the information you need to know about the plan you enrolled in The purpose of Form 1095C is to provide you the information you need to know about claiming the premium tax credit, reconcile the credit on your tax return with advance payments of the premium tax credit and file your federal income taxIRS Issues Draft Form 1095C / 1094C for ACA Reporting in 21 Click here to learn more about the changes in ACA Forms

1095 C Form 21 Irs Forms Zrivo

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

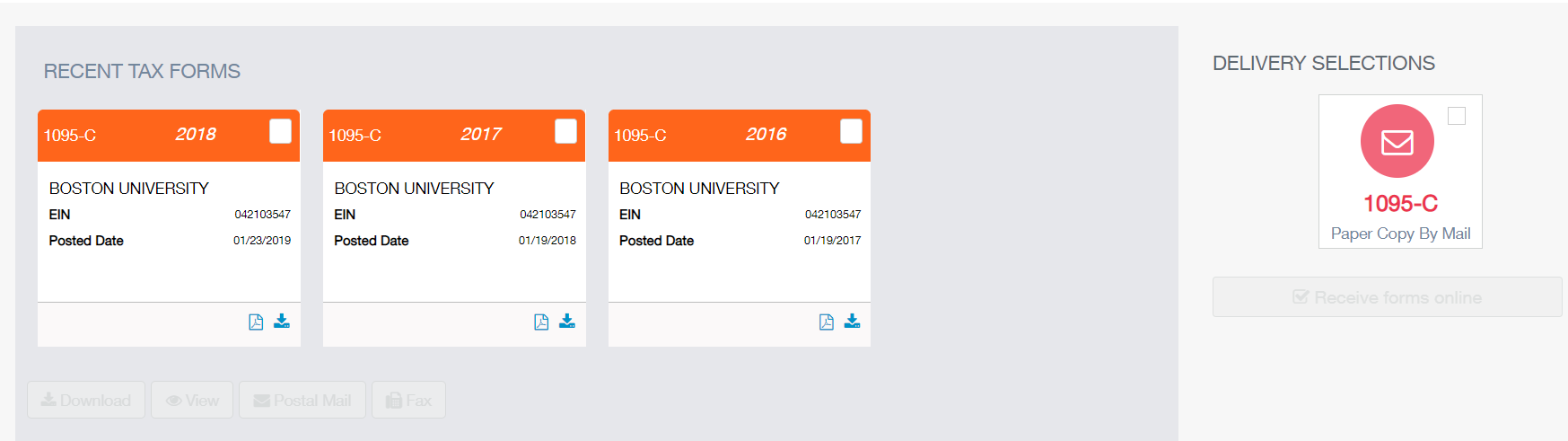

Related Forms 1095C Ever since mailing out a 1095C tax form was made compulsory in the 15 fiscal year, all ALEs are required to send these statements not only to their eligible employees but also to the IRS What are the Form 1095C deadlines? If you DO NOT follow the steps above and do not consent to receive your Forms W2, 1042S, and/or 1095C electronically by at 1059 pm CST, your forms will be mailed on , and Form 1095C will be mailed on , to the mailing address listed on your My Profile in the System HR website as of1095C Form 21 📝 Get IRS Form 1095C Fillable Instructions for Healthcare Marketplace Tax Form with Codes Description Get 📝 IRS Form 1095C 🟢 Form for employee's health insurance 🟢 Fill 1095 C Tax Form online or download printable version in PDF, DOC or RTF 🟢

1

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting document While not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094Cs The deadline for filing Forms 1094B, 1095B, 1094C or 1095C with the IRS remains , or , if filing electronically As a reminder, employers who are filing more than 250 of these reporting forms are required to file electronically The IRS has released final forms and instructions The due date for furnishing employee copy of 1095C is extended from , to If you fail to furnish employee copies, the IRS will not impose penalties For further information, see Notice 76 Beginning from , employers may offer HRAs integrated with individual

2

2

Form 1095C provides information about the health insurance coverage offered to you through your employer Who will get Form 1095C?Title _f1095cpdf Author SBanken Created Date PMThe IRS extends the Form 1095 recipient copy deadline from , to The 1095B / 1095C Forms need to be efiled with the IRS on or before If you choose to file ACA Forms by paper, you must file before Information Required for 21 ACA Reporting

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

How To Obtain W 2 1095 C Statements Postal Times

Form 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees The Internal Revenue Service (IRS) has released Notice 76, which extends the deadline for furnishing Forms 1095B and 1095C to individuals from to The Notice also provides penalty relief for goodfaith reporting errors and suspends the requirement to issue Form 1095B to individuals, under certain conditions Furnish Forms 1095C to your fulltime employees no later than This date was originally , but the IRS has since issued an extension Employers must electronically file the Forms 1094C and 1095C with the IRS no later than this date

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

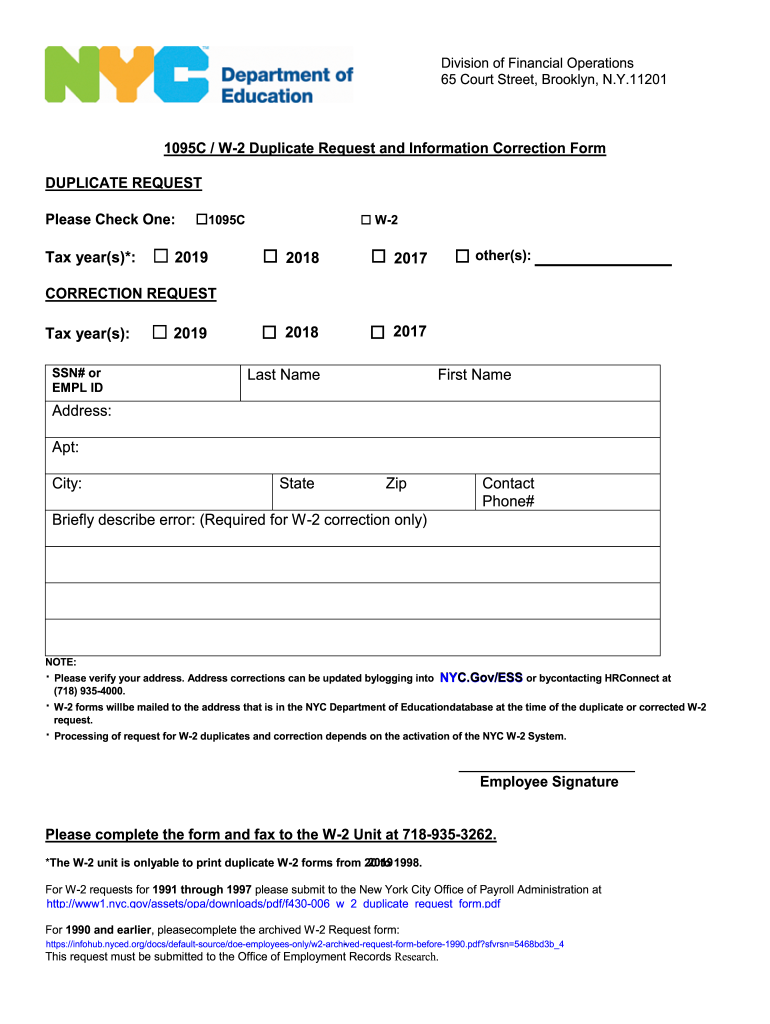

Ny 1095c W 2 Duplicate Request And Information Correction Form 19 21 Fill Out Tax Template Online Us Legal Forms

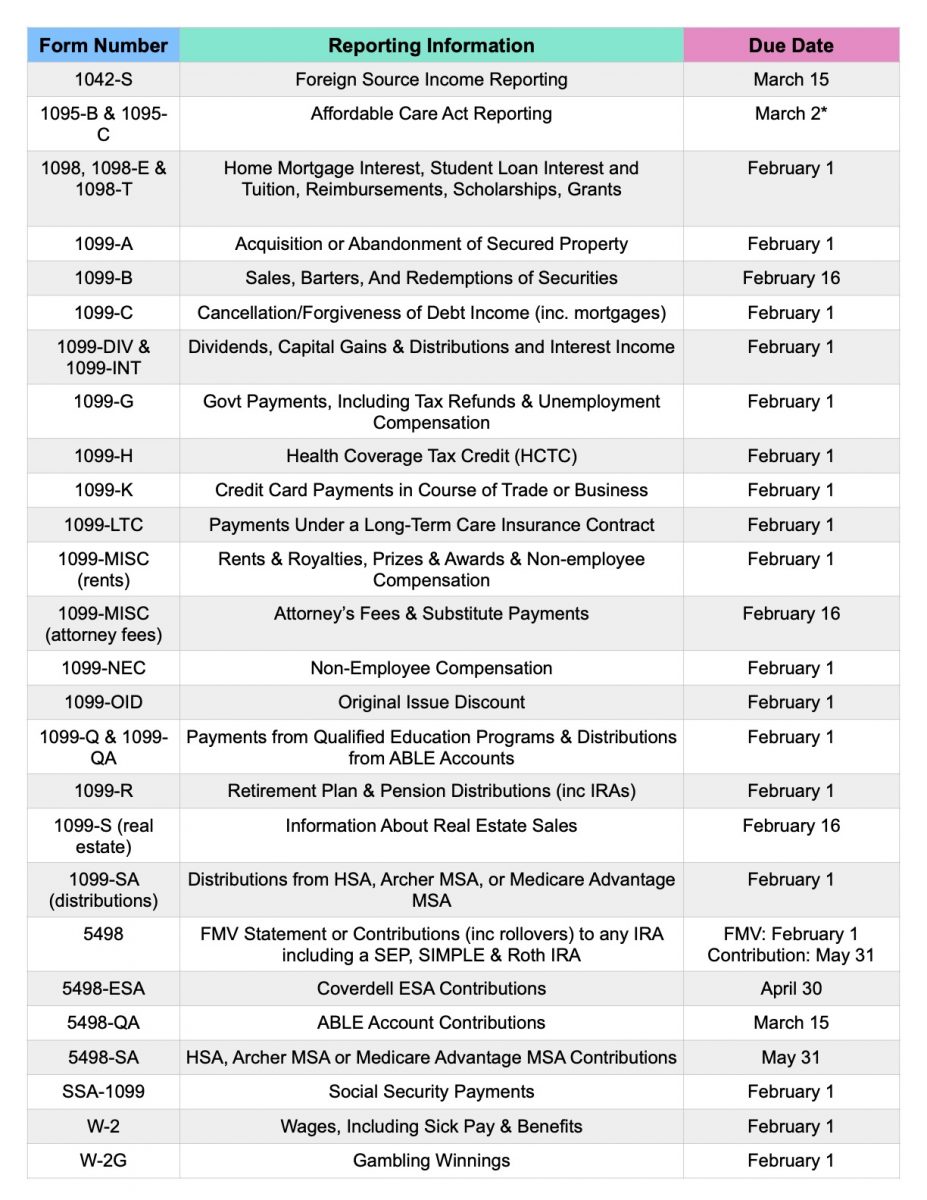

This guidance only applies to Form 1095B for insurers and Form 1095C for employers The original deadline to provide these Forms to insureds/employees was ; Form 1095c () instructions for recipient Updated 1095C Employer Reporting Guide The IRS recently provided the final 1095C employer reporting forms and instructions The 1095C forms were modified slightly, primarily to facilitate reporting by employers who offered individual coverage HRAs (ICHRAs) in The Form 1094Cs are pretty much identical to last year Minor Changes to FormThe deadline to file Form 1095B Recipient copy is March 02,21 and if filing by paper, March 01,21;if Efiling ,it is March 31,21 Know the deadlines of ACA Form 1095

2

Irs 1095 C 21 Fill Out Tax Template Online Us Legal Forms

However, the relief provides an extension to The other reporting obligations under Code §§ 6055 and 6056 were not provided an extension Form 1095C is a tax form that provides you with information about employerprovided health insurance Only employees who is offered coverage under a policy through an Applicable Large Employer (ALE) receive Forms 1095C, and it is the responsibility of the ALE to generate and furnish the documents to all employees who were fulltime (as defined by the ACA)If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21 However, you don't have to wait until then to file your return as you might get your information in a different way from your employer

Your 1095 C Tax Form For Human Resources

Irs Form 1095 C Uva Hr

Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee As in past years, there's some flexibility with the due date for the Form 1095C The deadline to provide the form to employees has been extended from Jan 31, 21, to When submitting returns to the IRS, the deadlines are , if mailing the forms and , if they're transmitted onlineKnow your ACA reporting requirements for tax year and efile your ACA 1094/1095 Forms before the 21 deadline Avoid receiving ACA penalty letters and paying millions of dollars as penalties!

Your 1095 C Obligations Explained

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

IRS Tax Return 21 Tax Form 1095A, 1095B, 1095C, FTB 35, Form 62 Health Insurance Tax Credit Covered California (CoveredCA), States Exchanges, and HeThe deadline to send forms 1095C and 1094C to the IRS on paper is , when filing electronically the due date is All data needed to fill 1095C / 1094C forms can be saved for later use and modification (forms stored for future access and corrections)A copy of Form 1095B or 1095C should be provided to your employees/recipients on or before

Aca Deadlines Penalties Extension For 21 Checkmark Blog

2

Explore Taxseer's board "1095 C form online" on See more ideas about irs forms, form, efileThus, a 1095C form will be sent in early January 21 The IRS expects every ALE to send in a completed 1095C printable form for each eligible employee by the end of February If they choose to fill out the statement electronically, the IRS allows them to submit a 1095C online form until the end of MarchThe due date for furnishing Form 1095C to individuals is extended from , to See Notice 76 and Extensions of time to furnish statements to recipients Relief for failure to furnish statements to certain employees enrolled in selfinsured health plan

2

Deadlines Ahead As Employers Prep For Aca Reporting In 21

Form 1095C provides employees with information regarding employerprovided health insurance coverage It specifies the months of health care coverage for the employee and their eligible dependents When completing their federal tax return, employees must indicate whether they had qualifying health coverage for all of or whether they qualified for a healthWhen is the deadline to file Form 1095C? The FORM 1095C EmployerProvided Health Insurance Offer and Coverage was mailed on Taxpayers do not need to wait to receive Forms 1095B and 1095C before filing their returns Taxpayers may rely on other information received from their employer or other coverage provider for purposes of filing their returns

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

News 1095 C Tax Form Coming Soon

The deadlines for filing Form 1095C with the IRS and furnishing copies to the recipient are as follows , is the deadline to distribute recipient copies , is the deadline to paper file Forms 1095C with the IRSInformation, put and request legallybinding digital signatures Do the job from any device and share docs by email or fax Check out now?ACA Reporting Penalties $280/Form Penalty, $560/Employee Penalty for Late/Incorrect Forms The general potential late/incorrect ACA reporting penalties are $280 for the late/incorrect Forms 1095C furnished to employees, and $280 for the late/incorrect Forms 1094C and copies of the Forms 1095C filed with the IRS

2

2

You must furnish Form 1095C to your employees by The due date for filing Forms 1094C and 1095C with the IRS is February 28th, 21 if filing by paper, and March 31st, 21 if filed electronicallyThe Internal Revenue Service (IRS) issued draft form 1095C that employers will use to report health coverage they offer to their employees as required by the Affordable Care Act (ACA) The form is for the 18 tax year (for filing in early 19) On the 18 Form 1095C the "plan start month" box will remain optional

A Guide To Forms 1095 1098 And Nonresident Tax Returns

2

Trisure Corporation Legal Alert Irs Extends Deadline For Furnishing Form 1095 C To Employees Facebook

Form 1095 C H R Block

Aca Reporting For Just Got More Complicated Syncstream Solutions

1

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

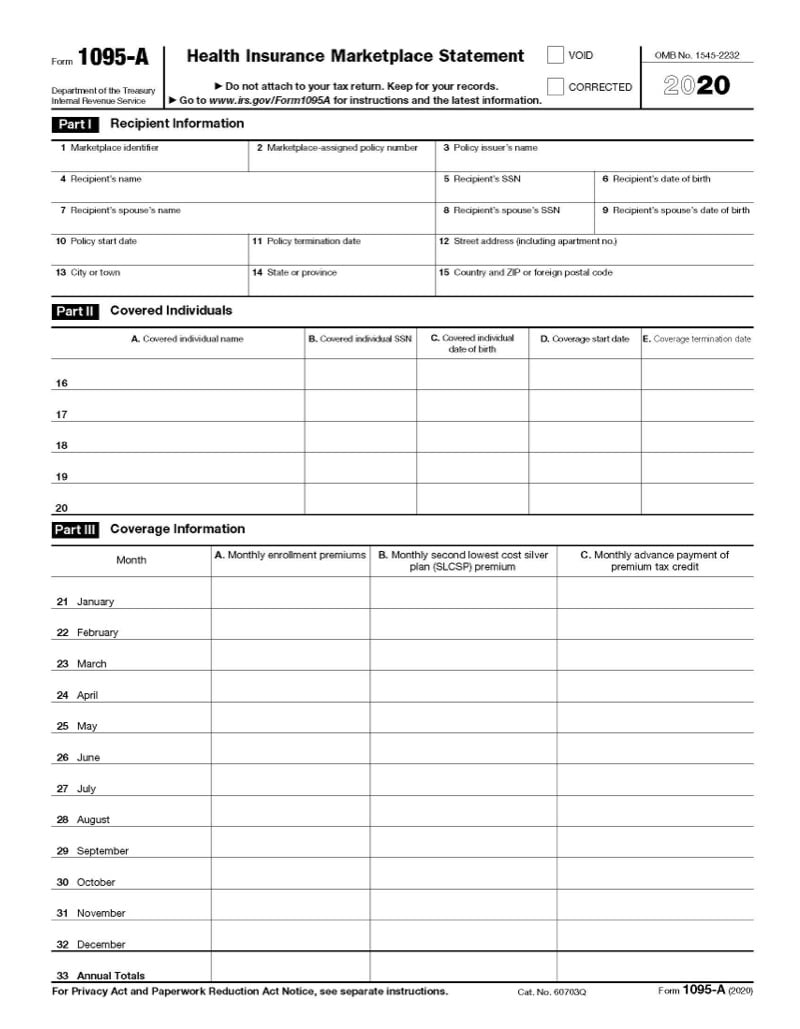

About Form 1095 A Health Insurance Marketplace Statement Definition

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

2

2

2

Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2

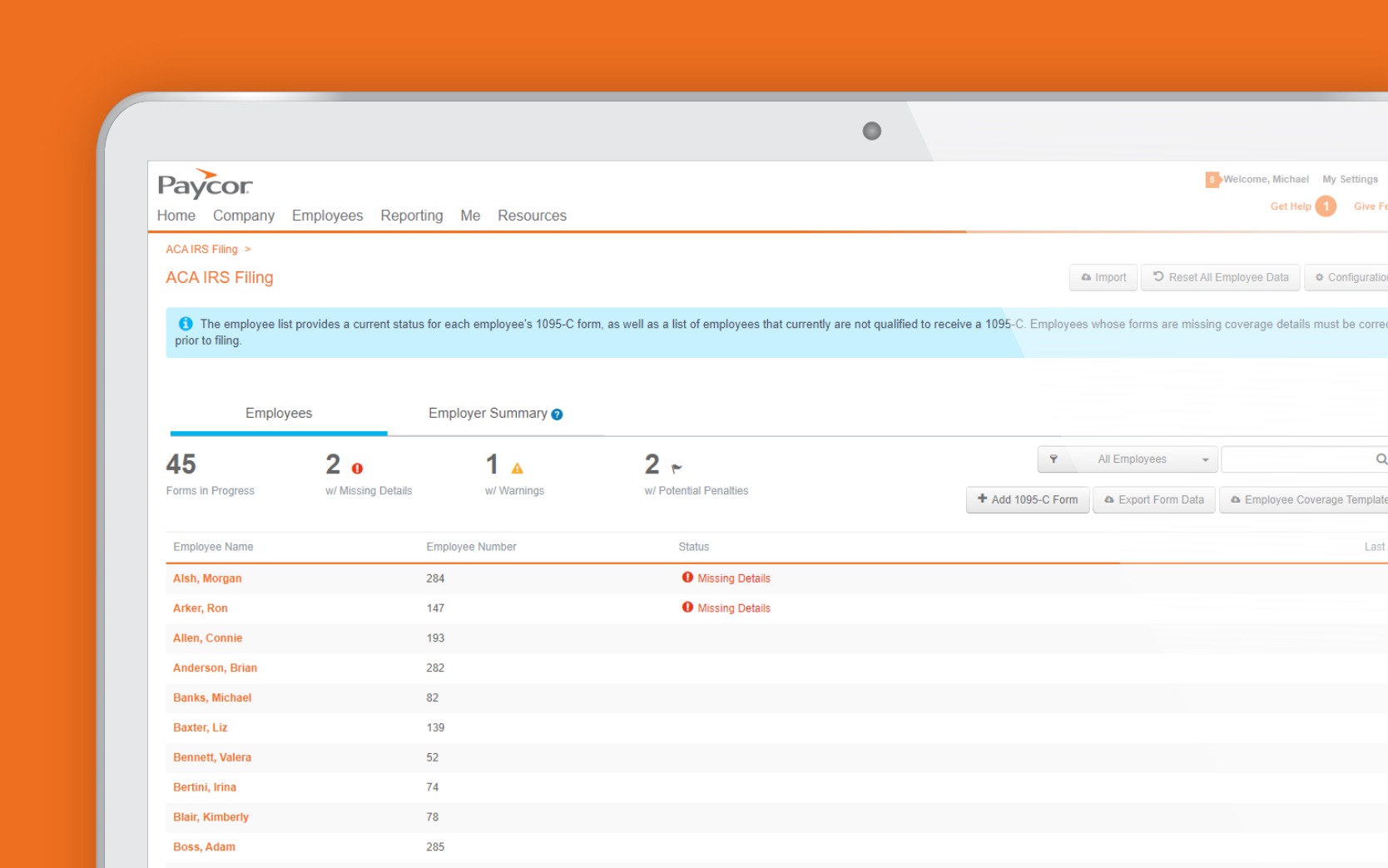

Aca Reporting Software Aca Compliance Paycor

7 Must Know 21 Hr Compliance Dates Workest

2

Irs Extends Deadline For Furnishing Form 1095 C To Employees Extends Good Faith Transition Relief For The Final Time Hmk

.png)

Flock Platform Hr Benefits Compliance Software

2

Your 1095 C Obligations Explained

What Is Form 1095 C Acawise Youtube

2

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

2

Form 1095 A 1095 B 1095 C And Instructions

1095 And 1094 Aca Forms Ez1095 Now Offers A Correction Form Feature For Customer Convenience

Look Out For Most Tax Forms Including Your W 2 By February 1 Taxgirl

The Irs S Forms 1095 For The Aca Explained The Aca Times

Form 1095 C Forms Human Resources Vanderbilt University

2

2

2

3

Aca Code Cheatsheet

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

2

2

2

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1095 C Form 21 Irs Forms

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Updates To Form 1095 C For Filing In 21 Youtube

2

What Is The Form 1095 C Youtube

Your 1095 C Tax Form For Human Resources

2

1095 C Faqs Mass Gov

1

How To Review 1095 C Software Solutions Bernieportal

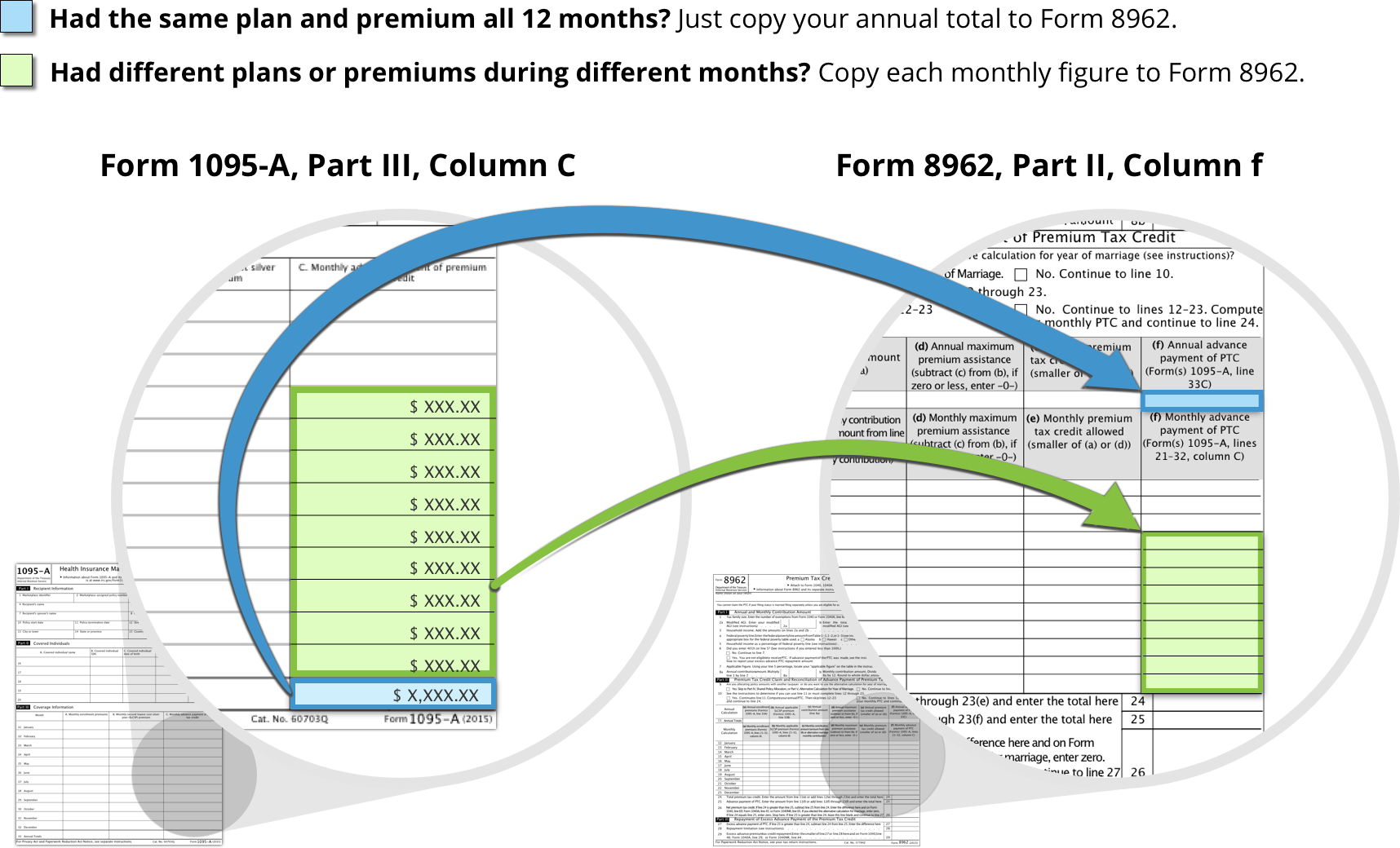

How To Reconcile Your Premium Tax Credit Healthcare Gov

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Coming Soon Irs Form 1095 For 19 Ucpath

2

Form 1094 C And Form 1095 C B Benchmark Planning Group

News Teamcare Request Your Form 1095 B

2

2

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

Form 1095 C Mailed On March 1 21 News Illinois State

The Irs Extends Aca Recipient Copy Deadline For The Tax Year Blog Acawise Aca Reporting Solution Business Rules Irs Important Dates

2

2

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Form 1095 C The Aca Times

Changes In 21 Aca Reporting Health Insurance Coverage Employment Health Plan

Irs Form 1095 Form Ftb 35 And Your Health Insurance Subsidy

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Tax Form 1095 A Frequently Asked Questions

2

2

2

Form 1095 A 1095 B 1095 C And Instructions

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

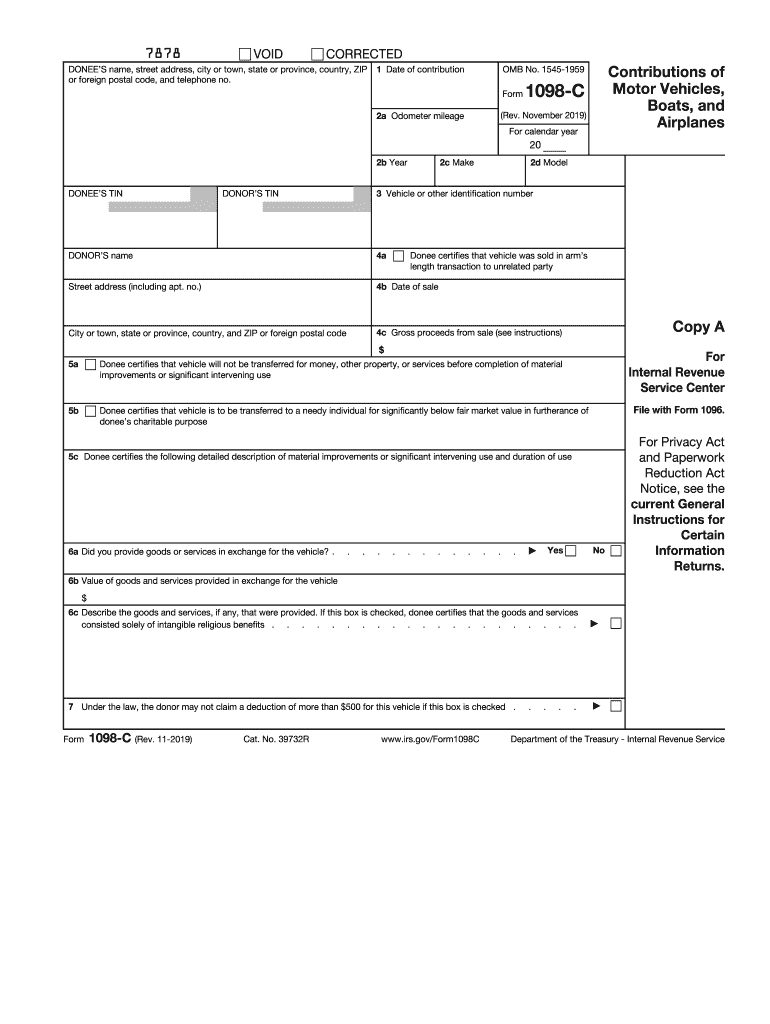

19 21 Form Irs 1098 C Fill Online Printable Fillable Blank Pdffiller

Updates To Form 1095 C For Filing In 21 Youtube

2

0 件のコメント:

コメントを投稿